How To Remove Late Payments From Credit History

Belatedly payments can be a large deal.

They count significantly toward your FICO score adding which and so many lenders check when you lot apply for a loan.

However, in my feel, information technology'due south really not that difficult to get late payments removed and run across a bump in your credit score.

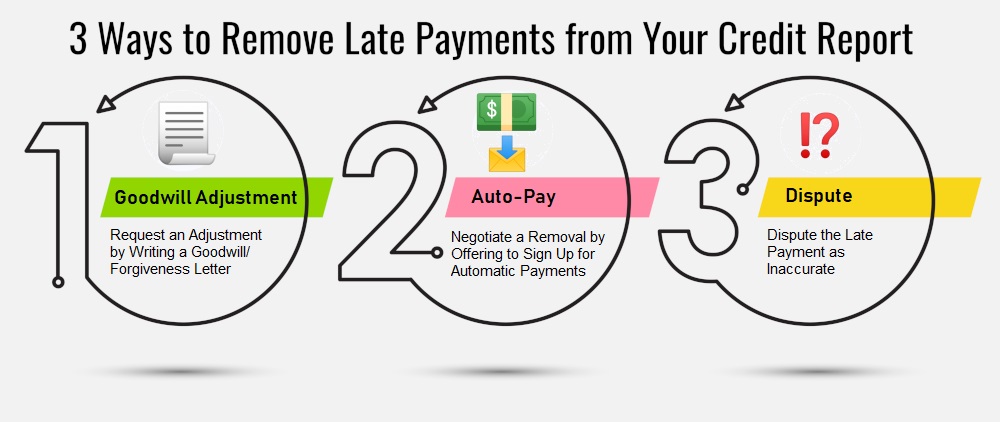

3 Means To Remove Late Payments From Your Credit Written report

Here are 3 proven ways to remove tardily payments from your credit report:

- Request a "Goodwill Adjustment" from the Creditor

- Negotiate to Remove a Late Payment by Signing Up for Machine-Pay

- Dispute the Late Payment Entry on Your Credit Report equally Inaccurate

1. Request a "Goodwill Aligning" from the Original Creditor

The thought is uncomplicated, and it works surprisingly well.

Many times creditors are happy to grant "goodwill adjustments" if your previous payment history is relatively adept and you lot have established a good human relationship with the creditor.

This is probably the easiest and surest style to become a late payment removed from your credit report.

The process involves writing the creditor a letter explaining your situation (why yous were late) and asking that they "forgive" the late payment and adjust your credit report accordingly.

The easiest style to get started is to use this goodwill/forgiveness letter of the alphabet template that I created. This method might not work if you have multiple late payments.

2. Negotiate Removal by Offering to Sign Up for Automatic Payments

I have never really tried this method myself, but from what I sympathize creditors frequently offer to remove late payment entries if you, in exchange, agree to sign upwards for automatic payments.

This strategy works well for both parties: the creditor tin can ensure hereafter on-time payments will be made, and you don't have to worry about remembering to brand payments or being charged tardily fees if you forgot to pay by the due date.

Of course, automatic payments are but skilful when yous have the money in your bank account to cover the transaction.

I would love to hear from those of you who have succeeded with this method!

UPDATE: Several readers have verified that this method did work for them, so try this next if a goodwill letter doesn't piece of work.

3. Dispute the Late Payment as Inaccurate

I certainly do not abet lying or claiming negative information is inaccurate when you know that you actually did brand tardily payments.

BUT, if you observe Whatsoever inaccuracies on the late payment entry (dates, amounts, etc), y'all can begin disputing the late payment as inaccurately reported.

Sometimes creditors have a difficult time verifying the exact details of your account history.

Therefore, if you write a dispute letter protesting the inaccurate late payment and the creditor tin can't verify it, the negative entry can be removed in accordance with the Fair Credit Reporting Deed (FCRA).

ACCURATE Data FROM THE CREDITOR SHOULD INCLUDE:

- Your name

- Creditor's name

- Payment information

- Business relationship number

Take A Professional Remove The Late Payments

We empathize that credit repair can exist overwhelming.

If you lot'd rather have a professional credit repair company assistance, I suggest you check out Lexington Law.

Credit repair experts like the ones at Lexington Constabulary may be able to remove inaccurate negative information on your behalf.

Credit repair companies volition typically charge a monthly subscription fee while y'all work with them just they're too like shooting fish in a barrel to cancel and at that place's no long-term delivery.

For someone with items that can be challenged, nearly times, progress tin typically be made in 45 or 90 days.

Enquire Lexington Law for Help

How Long Do Late Payments Stay On Your Credit Report?

Late payments can stay on your credit report for up to seven years from the original malversation date (which is the date of the missed payment).

This will impact your ability to get loans.

A lower credit score will as well affect the involvement rates you become if y'all do get canonical for a credit card or machine loan.

How Much Does a Tardily Payment Hurt My Credit?

If y'all take perfect or nearly-perfect credit, a late payment could knock upwardly of 100 points off your FICO score.

As yous can see, a unmarried late payment tin have a bigger impact on your credit file than you may think.

That'due south because payment history comprises 35% — the biggest chunk — of your credit score.

When you already have splendid credit, you have more room for ane negative detail to accept a big striking.

A single tardily payment volition have a smaller impact if your credit file already has some bug such equally multiple late payments or a charge-off or drove business relationship.

How to Keep Late Payments Off Your Credit File

If you're reading this and already have delinquencies reported on your credit report, it'southward patently too late to prevent the negative marks from appearing in your credit history.

You should stick to the methods I outlined in a higher place to remove the late payments and restore your credit.

But if yous aren't all the same 30 days tardily on a payment, read this department carefully.

You tin nevertheless foreclose a late payment from hurting your credit score.

Doing this will exist much easier than trying to remove the negative items from your credit report later.

Here's what yous tin can do:

Monitor Your Credit To Prevent Problems

Yes, yous can get your free credit study, simply some credit bill of fare companies and mortgage servicers offer free credit monitoring that's congenital into your everyday life.

Y'all can simply log into your account online or tap on an app to see your FICO or VantageScore anytime.

Experian offers free admission to your credit report on a monthly basis and provides free credit report monitoring as well.

You can also monitor your credit using free apps like Credit Sesame and Credit Karma.

These apps won't show your official FICO score but they tin can alarm you to big changes.

A big and sudden change to your credit score could be a sign of identity theft or of inaccurate late payments being reported by 1 of your creditors.

Detecting this kind of problem early will make fixing information technology easier.

Communicate with the Credit Issuer

Information technology'due south tempting to ignore past due bills, especially from credit carte du jour companies that can't plough off your utilities or repossess your car. But try to avoid this temptation.

A lot of credit accounts offering payment flexibility you should accept advantage of if you lot're struggling to make on-time payments.

Some companies volition let yous skip a payment so you can get your personal finances back on runway.

But you lot won't know about these possibilities if you don't go far impact with your creditor.

So don't ignore their phone calls or emails, specially when yous're withal not 30 days late.

Use Covid-19 Relief Programs If Possible

During the coronavirus pandemic a lot of creditors, such as student loan servicers, froze credit accounts.

Other creditors started Covid-nineteen relief programs for account holders who had been affected by the pandemic.

Still, others stopped sending late payment information to the three credit bureaus, Equifax, Experian, and TransUnion, or selling charge-off accounts to collection agencies.

This kind of assistance can assistance keep your accounts in proficient standing and help you keep good credit during challenging times.

But you lot may need to ask your creditor to enroll you in these programs. Again, communicating with your creditor before your account becomes xxx days or more delinquent will be central.

Change Due Dates or Consolidate If Helpful

Most credit menu issuers such as Capital letter One and Discover will permit yous change your due appointment to avert payment conflicts with other bills such as your rent or car loan payment.

Sometimes a simple change like this can create the relief you need to proceed your credit score on the upwards and upwards.

You could also consider consolidating several smaller credit menu balances into 1 larger credit card or personal loan.

You'd take fewer due dates to call up, and you lot could probably pay less in interest charges, too.

Knowing Your Rights Can Assistance Yous Negotiate Belatedly Payments

Congress has passed several laws to aid consumers negotiate with credit reporting agencies and creditors.

The Fair Credit Reporting Act, for example, gives yous access to your credit file for costless every year.

Visit annualcreditreport.com to get your free credit reports from the iii credit reporting bureaus.

If you discover inaccurate information, the law requires the bureaus to set up this information or remove it.

Be sure to file a complaint with the Consumer Financial Protection Bureau if your attempts to remove inaccurate negative information become no response.

How To Remove Late Payments From Credit History,

Source: https://bettercreditblog.org/3-ways-to-get-a-late-payment-removed-from-your-credit-report/

Posted by: rousseauoutte1960.blogspot.com

0 Response to "How To Remove Late Payments From Credit History"

Post a Comment